In today’s digital age, where transactions are increasingly conducted online, the risk of fraud has become a pressing concern for businesses and individuals alike. Fraudulent activities can lead to significant financial losses, compromised data, and eroded trust in institutions. To combat this growing threat, organizations are turning to advanced technologies such as machine learning algorithms for fraud detection.

Machine learning algorithms have revolutionized the field of fraud detection by leveraging the power of data analytics and artificial intelligence. These algorithms possess the ability to analyze vast amounts of data, detect complex patterns, and identify suspicious activities in real-time. By continuously learning and adapting to new fraud techniques, they provide businesses with a proactive defense against fraudulent behavior.

What are Machine Learning Algorithms for Fraud Detection?

Machine learning algorithms for fraud detection are computational techniques that leverage artificial intelligence and statistical models to analyze data and identify fraudulent activities. These algorithms are designed to learn from historical data patterns and detect anomalies or suspicious behavior in real-time. By utilizing advanced algorithms and techniques, machine learning models can effectively see fraudulent operations and differentiate between legitimate and fraudulent transactions or actions.

Understanding the Basics of Machine Learning Algorithms for Fraud Detection

Machine learning algorithms operate on the principle of learning from data. They analyze historical patterns, transactional data, user behaviors, and other relevant factors to build models that can identify fraudulent activities. These models are trained using labeled data, where known instances of fraud are marked, allowing the algorithm to learn the characteristics of fraudulent behavior.

Machine learning algorithms can be broadly categorized into two types: supervised and unsupervised learning. In supervised machine learning systems, the algorithm is trained using labeled data, meaning instances of fraud are explicitly identified. Unsupervised learning, on the other hand, involves analyzing unlabeled data to detect anomalies and patterns that deviate from the norm.

Types of Online Scams

The digital age has brought about an increase in online scams, posing significant risks to individuals and businesses alike. Machine learning algorithms are instrumental in detecting and combating these various types of online scams. Here are some common online scams that machine learning algorithms can help identify:

Phishing Scams

Phishing scams involve fraudulent attempts to obtain sensitive information, such as passwords, credit card details, or social security numbers, by impersonating legitimate entities. Machine learning algorithms can analyze email content, URLs, and user behavior to identify phishing attempts and prevent users from falling victim to these scams.

Identity Theft

Identity theft occurs when someone wrongfully obtains and uses another person’s personal information for fraudulent purposes. Machine learning algorithms can analyze patterns and anomalies in user activities, account behavior, and transaction history to flag potential instances of identity fraud transactions or theft.

Online Purchase Scams

Online purchase scams involve fraudulent sellers or websites that deceive buyers into paying for goods or services that are never delivered. Machine learning algorithms can detect suspicious seller behavior, analyze customer reviews, and identify unusual transaction patterns to help prevent such scams.

Investment and Financial Scams

Machine learning algorithms can assist in detecting investment and financial scams, including Ponzi schemes, fraudulent investment opportunities, and fake financial institutions. By analyzing historical data, user behavior, and transaction patterns, these algorithms can flag suspicious activities and alert users to potential scams.

Romance Scams

Romance scams target individuals looking for romantic relationships online. Fraudsters create fake profiles and manipulate victims into sending them money or providing personal information. Machine learning algorithms can analyze communication patterns, profile information, and social network connections to identify potential romance scams.

Advantages of Machine Learning Algorithms in Fraud Detection

Machine learning algorithms revolutionize fraud detection by offering enhanced accuracy, efficiency, and adaptability.

Here are Some Notable Advantages:

Real-time Detection: Quickly identify fraudulent activities as they occur.

Automated Data Analysis: Automatically analyze complex and large-scale data sets, uncovering patterns and anomalies.

Adaptability to New Fraud Patterns: Stay ahead of fraudsters by detecting evolving fraud techniques.

Enhanced Accuracy: Identify subtle patterns indicative of fraud, minimizing false positives and negatives.

Scalability: Efficiently analyze large volumes of data to detect fraudulent activities.

Integration with Existing Systems: Seamlessly integrate with current fraud detection systems.

Continuous Learning: Improve detection capabilities over time by continuously learning from new data.

In summary, machine learning algorithms offer significant advantages in fraud detection, including real-time detection, automated analysis, adaptability to new patterns, enhanced accuracy, scalability, integration with existing systems, and continuous learning. These benefits empower organizations to proactively detect and prevent fraudulent activities, safeguarding their financial assets and maintaining customer trust.

Disadvantages of Machine Learning Algorithms for Fraud Detection

While machine learning algorithms bring numerous advantages to fraud detection, it is important to acknowledge their limitations and potential challenges. Here are some key disadvantages associated with the use of machine learning algorithms for fraud detection:

Data Quality and Bias

Machine learning algorithms heavily rely on the quality and accuracy of the data used for training. If the training data contains errors, inconsistencies, or biases, it can lead to inaccurate or biased fraud detection outcomes. It is crucial to ensure that the training data is clean, representative, and free from any inherent biases to avoid misleading results.

Lack of Interpretability

Machine learning algorithms, such as deep neural networks, can be highly complex and operate as black boxes, making it challenging to interpret and understand the reasoning behind their decisions. This lack of interpretability can be a concern, especially in sensitive applications like fraud detection, where explanations for fraud alerts are required for regulatory or compliance purposes.

Adversarial Attacks

Fraudsters are continually evolving their techniques to evade detection systems. They may employ adversarial attacks, intentionally manipulating data patterns or introducing subtle anomalies to deceive machine learning algorithms. This cat-and-mouse game between fraudsters and detection algorithms requires ongoing monitoring and updates to ensure algorithm robustness.

Cost and Resource Intensiveness

Implementing and maintaining machine learning algorithms for fraud detection can require substantial computational resources, including high-performance hardware and storage capabilities. Additionally, training and fine-tuning machine learning models can be time-consuming and resource-intensive, especially when dealing with large-scale datasets.

Over-reliance on Historical Data

Machine learning algorithms heavily depend on historical data to identify patterns and detect fraud. While this approach is effective in detecting known fraud patterns, it may struggle to detect novel or previously unseen fraud techniques. Fraudsters constantly adapt their methods, and if the training data does not adequately capture these evolving patterns, there is a risk of false negatives or delayed detection.

Regulatory Compliance

The use of machine learning algorithms for fraud detection may raise concerns related to privacy and regulatory compliance. Organizations must ensure that their fraud detection practices adhere to applicable data protection regulations and maintain transparency in their use of personal and sensitive data.

It is important to recognize these disadvantages and address them appropriately when implementing machine learning algorithms for a fraud detection system. A balanced approach that combines machine learning with human expertise, regular model monitoring and updates, and ethical considerations can help mitigate these challenges and enhance the overall effectiveness of fraud detection systems.

How to Detect Fraud Using Machine Learning

Fraud detection using machine learning involves a systematic approach that utilizes advanced algorithms and data analysis techniques to predict fraud. By following these steps, organizations can effectively detect and combat fraudulent activities:

Data Collection and Preparation

Gather relevant data for fraud detection, including transaction records, user profiles, and account activity logs. Ensure the data’s quality, completeness, and consistency.

Feature Engineering

Select and create meaningful variables, or features, from the collected data. These features capture important information that can help identify fraudulent activities, such input data such as transaction amounts, timestamps, and user behavior patterns.

Model Selection

Choose an appropriate machine learning model for fraud detection based on the problem and available data. Models like logistic regression, decision trees, random forests, support vector machines, and neural networks are commonly used.

Model Training and Evaluation

Split the data into training and testing sets. Train the selected machine learning model using labeled training data and evaluate its performance on the testing set using metrics like accuracy, precision, recall, and F1-score.

Anomaly Detection

Implement unsupervised learning techniques to identify anomalies or unusual patterns in the data that may indicate fraudulent activities. Clustering or autoencoders can be used to detect outliers or deviations from expected behavior.

Real-Time Monitoring

Set up a system for real-time monitoring of transactions, user behavior, or other relevant data. Machine learning algorithms can analyze incoming data, compare it with learned patterns, and raise alerts or take immediate actions when suspicious activities are detected.

Model Refinement and Iteration

Continuously refine and improve the machine learning model based on feedback and new data. Regularly retrain the model using updated data to adapt to evolving fraud patterns and enhance detection accuracy.

Collaboration with Domain Experts

Foster collaboration between data scientists and domain experts, such as fraud analysts or investigators. Their expertise can provide valuable insights, help fine-tune the model, interpret results, and validate detected fraud cases.

Human-in-the-Loop Approach

Acknowledge the importance of human intervention alongside machine learning algorithms. Implement a human-in-the-loop approach where suspected fraud cases flagged by the algorithm are further investigated by fraud analysts or investigators for final confirmation.

Ongoing Monitoring and Maintenance

Fraud detection using a machine learning system is an ongoing process. Continuously monitor the system’s performance, update the model with new data, and stay informed about emerging fraud patterns and techniques. Regularly evaluate the system’s effectiveness and make necessary adjustments as needed.

By following these steps and continuously improving the machine learning models, organizations can develop robust fraud detection systems that leverage advanced algorithms and data analysis to mitigate the risks posed by fraudulent activities.

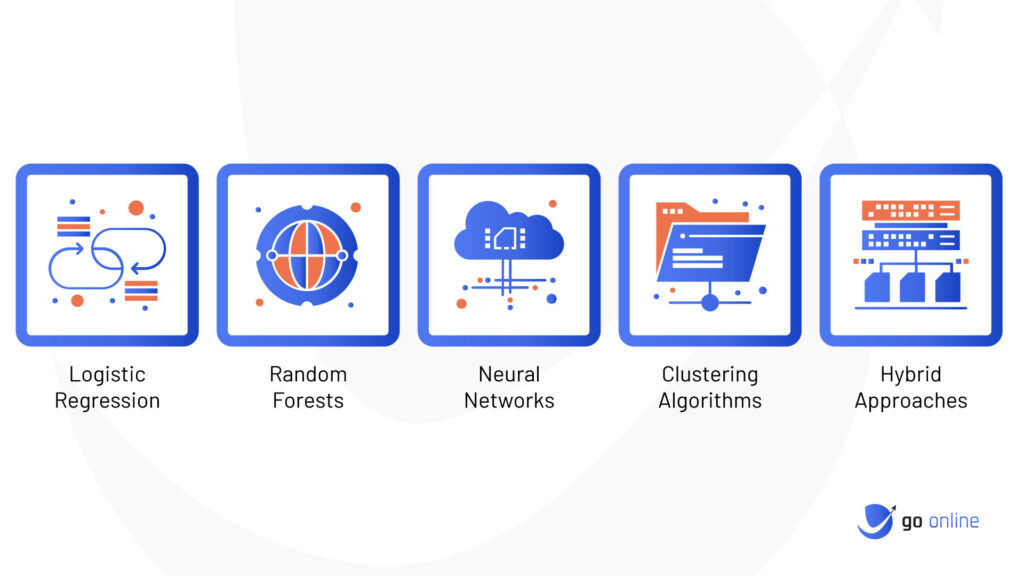

Popular Algorithms for Fraud Detection in Machine Learning

Fraud detection relies on powerful machine learning algorithms. Here are some commonly used ones:

Logistic Regression: Estimates event probabilities, ideal for binary fraud classification.

Decision Trees: Tree-like models for spotting fraud patterns in different data types.

Random Forests: Combines decision trees for improved accuracy and robustness.

Support Vector Machines (SVM): Finds optimal hyperplanes to separate classes in high-dimensional data.

Neural Networks: Learns complex patterns and relationships, especially deep learning models.

Gradient Boosting Algorithms: Handles imbalanced data and captures feature interactions.

Clustering Algorithms: Groups similar transactions to identify outliers or anomalous clusters.

Hidden Markov Models (HMM): Captures temporal dependencies in sequential data.

Ensemble Methods: Combines models to enhance performance and reduce biases.

Hybrid Approaches: Blends rule-based systems with machine learning models.

Choosing the right algorithm depends on specific requirements and dataset characteristics. Experimentation and combinations multiple payment methods can optimize fraud detection.

Why We Need Machine Learning Algorithms to Detect Fraud

In today’s digital landscape, fraud has become an ever-present threat for businesses across various industries. To combat this growing problem, organizations are increasingly turning to machine learning algorithms for fraud detection. These advanced algorithms offer a range of advantages that make them indispensable in the fight against fraudulent activities. Let’s delve into why machine learning algorithms are essential for effective fraud detection:

Efficient Processing of Big Data

Fraud detection involves sifting through massive amounts of transactional and user data in real-time. Machine learning algorithms excel at handling big data by efficiently processing and analyzing it. This enables them to identify hidden patterns, anomalies, and indicators of potential fraud that might go unnoticed by traditional methods.

Adaptability to Emerging Fraud Patterns

Fraudsters are constantly evolving their tactics to stay one step ahead. Rule-based systems alone may struggle to keep pace with these ever-changing fraud patterns. However, machine learning algorithms have the remarkable ability to adapt and learn from new data. This allows them to detect and respond to emerging fraud trends, safeguarding businesses from evolving threats.

Automation for Speed and Accuracy

Manual fraud detection processes are not only time-consuming but also prone to human error. Machine learning algorithms offer automation, which significantly speeds up the payment fraud detection process while ensuring a higher level of accuracy. By automating the analysis of vast amounts of data, these algorithms can identify potential fraudulent activities swiftly, saving organizations valuable time and resources.

Identification of Complex Fraud Indicators

Fraudulent activities often involve intricate patterns and relationships that may elude conventional detection methods. Machine learning algorithms, particularly deep learning models, excel at identifying complex interactions between various data points. By capturing these subtle indicators, machine learning algorithms can spot even the most sophisticated fraud attempts.

Real-Time Detection and Response

Traditional fraud detection approaches often suffer from delays in identifying and responding to fraudulent activities. Machine learning algorithms operate in real-time, enabling immediate detection and swift response to fraudulent incidents. By analyzing transactions and user behavior in real-time, these algorithms can flag suspicious activities, allowing businesses to take prompt action and mitigate potential losses.

Scalability for Growing Data Volumes

As businesses expand and transaction volumes increase, fraud detection systems must be capable of handling larger data sets. Machine learning algorithms are highly scalable and can seamlessly process and analyze massive volumes of data. This scalability ensures consistent performance and accurate fraud detection even as business operations scale up.

Reducing False Positives

Manual rule-based systems often generate a significant number of false positives, mistakenly flagging legitimate transactions as fraudulent. Machine learning algorithms, when properly trained and optimized, can significantly reduce false positives. This helps minimize disruptions to genuine customers and improves the overall efficiency of fraud detection systems.

Continuous Learning and Improvement

Machine learning algorithms have the advantage of continuous learning. By analyzing new data, these algorithms can refine and improve their detection capabilities over time. This iterative learning process ensures that the algorithms stay updated with emerging fraud patterns, enhancing their overall effectiveness.

Incorporating machine learning algorithms into fraud detection processes empowers organizations to stay one step ahead of fraudsters. These algorithms offer the speed, adaptability, accuracy, and scalability required to detect and combat fraud effectively. By leveraging the power of machine learning in fraud against, businesses can safeguard their operations, protect their customers, and minimize financial losses caused by fraudulent activities.

Which Machine Learning Algorithm is Best for Fraud Detection?

When it comes to fraud detection, selecting the right machine learning algorithm is crucial to achieve accurate and effective results. Various machine learning algorithms can be employed for fraud detection, each with its strengths and suitability for different scenarios. Let’s explore some of the top machine learning algorithms commonly used in fraud detection:

Logistic Regression

Logistic regression is a widely used algorithm for binary classification tasks, making it applicable for fraud detection. It works by estimating the probability of an event occurring based on input variables. Logistic regression is known for its simplicity, interpretability, and efficiency in processing large datasets.

Decision Trees

Decision tree algorithms create a tree-like model to make decisions based on features in the data. They are effective in capturing complex patterns and relationships, making them suitable for many fraud detection algorithms. Decision trees are easy to interpret and provide insights into the decision-making process.

Random Forest

Random forest is an ensemble learning algorithm that combines multiple decision trees to make predictions. It improves the accuracy and robustness of the model by reducing overfitting and capturing a broader range of patterns. Random forest can handle large datasets and is resilient to outliers, making it a popular choice for fraud detection.

Gradient Boosting Algorithms

Gradient boosting algorithms, such as XGBoost and LightGBM, are powerful techniques for fraud detection. They create a strong predictive model by iteratively boosting weak learners. Gradient boosting algorithms excel in handling imbalanced datasets and capturing intricate fraud patterns.

Neural Networks

Neural networks, particularly deep learning models, have gained significant attention in recent years for fraud detection. These models can learn complex representations and relationships in the data, making them effective in identifying subtle fraud patterns. Deep learning models, such as convolutional neural networks (CNNs) and recurrent neural networks (RNNs), can process sequential and spatial data, respectively, enhancing fraud detection capabilities.

Support Vector Machines (SVM)

SVM is a supervised learning algorithm that separates data points into different classes using hyperplanes. SVM is effective in handling high-dimensional data and can capture non-linear relationships. It works well for fraud detection tasks where the classes are separable by a clear margin.

It is essential to note that there is no one-size-fits-all solution when it comes to selecting the best machine learning algorithm for fraud detection. The choice depends on the specific requirements, characteristics of the dataset, and the types of fraud patterns to be detected. Additionally, ensembling multiple algorithms or using hybrid approaches can further enhance the detection accuracy and robustness.

To determine the most suitable algorithm, organizations often perform extensive testing and evaluation using historical data and real-world scenarios. By leveraging the strengths of various machine learning algorithms and adapting them to the specific fraud detection context, businesses can establish robust and effective fraud detection systems that safeguard their operations and protect against financial losses.

Which Companies Can Use Machine Learning Algorithms to Detect Fraud?

Machine learning algorithms have proven to be invaluable tools in fraud detection across various industries. Companies of all sizes and sectors can leverage these algorithms to enhance their fraud detection capabilities and safeguard their operations. Here are some examples of industries and companies that can benefit from using machine learning algorithms for fraud detection:

Banking and Financial Services

Banks and financial institutions are prime targets for fraudulent activities. By implementing machine learning algorithms, these organizations can detect and prevent various types of fraud, including credit card fraud, identity theft, money laundering, and fraudulent transactions. Companies such as JPMorgan Chase, Citigroup, and PayPal have implemented machine learning algorithms to enhance their fraud detection systems.

E-commerce and Retail

With the rise of online shopping, e-commerce platforms and retail businesses face the challenge of detecting fraudulent activities, such as payment fraud, account takeovers, and fake reviews. Companies like Amazon, Alibaba, and eBay utilize machine learning algorithms to analyze customer behavior, transaction patterns, and other data points to identify and mitigate fraudulent activities.

Insurance

Insurance companies deal with fraudulent claims, policy abuse, and organized fraud rings. Machine learning algorithms can help analyze historical claims data, identify suspicious patterns, and flag potentially fraudulent cases. Companies like Allianz, AXA, and Progressive leverage machine learning algorithms to improve their fraud detection capabilities and protect against fraudulent insurance claims.

Healthcare

The healthcare industry is vulnerable to fraud, including insurance fraud, prescription fraud, and billing fraud. Machine learning algorithms can analyze medical records, billing data, and patient information to identify anomalies and potentially fraudulent activities. Companies like Cigna, Optum, and Blue Cross Blue Shield employ machine learning algorithms to detect and prevent healthcare fraud.

Telecom and Communication

Telecommunication companies face challenges related to SIM card fraud, subscription fraud, and call detail record fraud. Machine learning algorithms can analyze call patterns, network data, and customer behavior to detect suspicious activities and prevent fraud. Companies like AT&T, Vodafone, and Verizon utilize machine learning algorithms for fraud detection in the telecom industry.

Government Agencies

Government organizations, including tax authorities and law enforcement agencies, can leverage machine learning algorithms to detect fraud in areas such as tax evasion, welfare fraud, and public procurement fraud. These algorithms can analyze vast amounts of data and identify irregularities or suspicious patterns. Government entities around the world are increasingly adopting machine learning algorithms for fraud detection purposes.

These are just a few examples of industries and companies that can benefit from incorporating machine learning algorithms into their fraud detection strategies. By utilizing these advanced algorithms, businesses can enhance their ability to identify and prevent fraudulent activities, minimize financial losses, protect their customers, and maintain trust in their operations.

5 Applications of Machine Learning Algorithms to Detect Fraud

Machine learning algorithms have revolutionized the field of fraud detection, providing advanced techniques to identify and prevent fraudulent activities across various domains. Here are five key applications of machine learning algorithms in detecting fraud:

Machine learning algorithms have revolutionized fraud detection across various domains. Here are five key applications:

- Credit Card Fraud Detection: Real-time analysis flags unauthorized transactions and enhances cardholder security.

- Insurance Fraud Detection: Identifies patterns in claims data to reduce losses and ensure fair compensation.

- E-commerce Fraud Prevention: Analyzes customer behavior to detect payment fraud and protect online businesses.

- Healthcare Fraud Detection: Uncovers anomalies in medical records and billing data to prevent fraud.

- Cybersecurity and Network Intrusion Detection: Identifies suspicious activities to proactively respond to cybersecurity threats.

Summary

In conclusion, machine learning algorithms have emerged as powerful tools for fraud detection, offering a range of advantages and opportunities for businesses to combat fraudulent activities. By harnessing the capabilities of these algorithms, organizations can enhance their fraud detection systems, protect their assets, and maintain trust among their customers.

However, it’s important to acknowledge the challenges associated with machine learning algorithms in fraud detection, such as the requirement for high-quality and diverse data, potential biases, and the need to stay ahead of sophisticated fraud techniques. Overcoming these challenges requires a comprehensive approach, including continuous monitoring, regular model updates, and collaboration between data scientists, fraud experts, and business stakeholders.

In a world where fraud continues to pose significant threats, machine learning algorithms offer a promising solution. They empower businesses to leverage the power of data and advanced analytics to detect and combat fraud effectively. By embracing these technologies, organizations can bolster their fraud detection capabilities, mitigate risks, and maintain the integrity of their operations.