Artificial intelligence (AI) is revolutionizing various industries, and the insurance sector is no exception. As advancements in technology continue to reshape the way we do business, AI presents a unique opportunity for your insurance organization to enhance underwriting processes, improve risk assessment, and unlock new dimensions of work. From automating manual tasks to leveraging machine learning algorithms for data analysis, AI empowers insurance professionals to make more informed decisions, streamline operations, and provide personalized experiences to customers.

Join us as we uncover the potential of AI in revolutionizing insurance underwriting and discover a new frontier of possibilities in commercial underwriting in this ever-evolving digital age.

What Does AI Mean in Insurance?

In the realm of insurance, artificial intelligence (AI) is revolutionizing the way companies operate, transforming traditional practices and opening up new avenues for growth and efficiency. AI refers to the development of computer systems that can perform tasks that typically require human intelligence, such as perception, reasoning, learning, and problem-solving. In the context of insurance, AI technology encompasses a wide range of applications, from underwriting and claims processing to customer service and fraud detection. One of the key areas where AI is making a significant impact is in underwriting, the process of assessing risks and determining the terms and conditions of insurance policies.

Traditionally, underwriting has relied on manual analysis of policy applications, extensive paperwork, and time-consuming assessments. However, with AI, insurers can leverage sophisticated algorithms and machine learning models to automate and streamline the underwriting process. AI systems can quickly analyze vast amounts of data, including historical claims, market trends, and customer information, to evaluate risks more accurately and make informed decisions. This not only speeds up the underwriting process but also improves risk assessment and pricing accuracy, allowing insurers to offer more tailored policies to their customers.

Another area where AI is transforming insurance is claims processing. Traditionally, claims management has been a labor-intensive process involving manual paperwork, data entry, and human decision-making. However, AI-powered systems can now automate many aspects of claims processing, from initial reporting and documentation to fraud detection and claims settlement. By leveraging AI algorithms, insurers can analyze claims data, assess the validity of claims, and expedite the settlement process. AI can also play a crucial role in fraud detection by flagging suspicious patterns, identifying potential fraudulent claims, and minimizing financial losses for insurance companies.

AI is driving advancements in customer service and experience within the insurance industry. Chatbots and virtual assistants powered by AI technology are being deployed to provide instant support and assistance to policyholders, answering their queries, guiding them through the claims process, and offering personalized recommendations. These AI-driven interfaces can enhance customer engagement, improve response times, and deliver round-the-clock service, ultimately leading to greater customer satisfaction and loyalty.

How does Artificial Intelligence Change the Conclusion of Insurance Contracts?

Artificial intelligence (AI) is revolutionizing the conclusion of insurance contracts by streamlining and enhancing the entire process. Traditionally, the conclusion of insurance contracts involved a complex and time-consuming series of steps, including gathering customer information, assessing risks, determining policy terms, and finalizing the agreement. However, with the advent of AI, insurers are leveraging advanced algorithms and machine learning models to automate and optimize these processes.

One of the key ways AI changes the conclusion of insurance contracts is through the automation of data collection and analysis. AI systems can efficiently gather and analyze vast amounts of data from various sources, including customer profiles, historical claims data, market trends, and external databases. By automating data collection and analysis, AI significantly reduces the time and effort required to assess risks accurately and determine appropriate policy terms. This not only speeds up the conclusion of insurance contracts but also improves the accuracy and granularity of risk assessment, allowing insurers to offer more tailored policies to their customers.

AI enables insurers to leverage predictive analytics to assess risks and price policies more accurately. By analyzing historical data and identifying patterns and correlations, AI algorithms can predict future claim probabilities and estimate potential losses. This allows insurers to set premiums that align with the risk profile of the policyholder, ensuring fair pricing and minimizing adverse selection. AI-driven predictive analytics also help insurers identify emerging risks, anticipate market shifts, and make data-driven decisions when concluding insurance contracts. AI enhances the customer experience during the conclusion of insurance contracts.

Through the use of AI-powered chatbots and virtual assistants, insurers can provide instant support and guidance to customers, answering their queries, explaining policy terms, and assisting with the application process. These AI-driven interfaces offer a seamless and personalized experience, enabling customers to obtain insurance coverage efficiently and conveniently. AI also facilitates real-time communication and customer interactions, eliminating the need for lengthy paperwork and enabling faster contract conclusion.

Four Trends Related to the Shaping of Insurance by Artificial Intelligence

Advanced Risk Assessment

Advanced Risk Assessment is shaping the insurance industry by revolutionizing the way insurers evaluate and manage risks. With the power of artificial intelligence and machine learning, insurers can now tap into vast amounts of data and extract meaningful insights to enhance their risk assessment capabilities. AI algorithms analyze diverse data sources, including historical claims data, customer demographics, external market trends, and more, to identify patterns, correlations, and hidden risk factors that traditional methods may miss.

This allows insurers to make more accurate underwriting decisions, price policies more effectively, and optimize risk management strategies. By leveraging AI-driven risk assessment, insurers can gain a deeper understanding of individual risks and develop personalized insurance solutions tailored to customers’ specific needs. This shift from a one-size-fits-all approach to a more customized and precise risk assessment model improves customer satisfaction, increases the likelihood of providing appropriate coverage, and reduces the potential for underwriting losses.

Enhanced Claims Processing

Enhanced Claims Processing is reshaping the insurance industry by streamlining and optimizing the claims handling process through the use of advanced technologies such as artificial intelligence. With AI-powered systems, insurers can automate and expedite various steps involved in claims processing, leading to faster and more accurate assessments, settlements, and customer service.

By leveraging machine learning algorithms, insurers can analyze historical claims data, policy information, and other relevant factors to detect patterns and anomalies, flag potential fraudulent activities, and make data-driven decisions on claims eligibility and settlement amounts. This not only reduces the time and effort required for manual review but also improves accuracy and ensures fair and consistent claims outcomes.

Personalized Customer Experience

AI-powered Personalized Customer Experience is revolutionizing the insurance industry, elevating the level of service and engagement insurers can offer to their customers. By harnessing the power of artificial intelligence, insurers can leverage vast amounts of customer data to create personalized experiences that cater to individual needs, preferences, and behaviors.

With AI, insurers can analyze and interpret customer data in real-time, uncovering valuable insights that enable them to deliver targeted and relevant customer interactions throughout. From customized policy recommendations to personalized communication channels, AI enables insurers to offer tailored solutions that meet the unique requirements of each customer.

Moreover, AI-powered Personalized Customer Experience enhances customer engagement through proactive communication, intelligent chatbots, and virtual assistants. These technologies provide round-the-clock support, prompt responses to inquiries, and intuitive self-service options, improving overall customer satisfaction and convenience.

Fraud Detection and Prevention

AI-powered Fraud Detection and Prevention is reshaping the insurance industry by significantly enhancing its ability to identify and combat fraudulent activities. With the immense volume of data generated in the insurance sector, traditional methods of fraud detection fall short in effectively identifying and preventing fraudulent claims. However, AI brings a new level of sophistication to this critical aspect of the industry.

By leveraging machine learning algorithms, AI can analyze vast amounts of data, identify patterns, and detect anomalies that may indicate fraudulent behavior. It can quickly identify suspicious claims, assess their validity, and flag potential cases for further investigation.

This not only helps insurers save substantial amounts of money by preventing fraudulent payouts but also protects the integrity of the entire insurance system. AI-powered Fraud Detection and Prevention continuously learns and evolves as it encounters new fraud schemes, adapting to the ever-changing tactics employed by fraudsters. This adaptability ensures that insurers stay one step ahead in the fight against fraud.

How Insurers Can Prepare for AI?

As the insurance industry embraces the transformative potential of artificial intelligence (AI), it is crucial for insurers to proactively prepare for the adoption and integration of AI into their operations. Here are several key steps that insurers can take to effectively prepare for AI.

Insurers need to invest in data management and infrastructure. AI heavily relies on large volumes of high-quality data to train its algorithms and make accurate predictions. Insurers should assess their data collection, storage, and management systems to ensure they have the necessary infrastructure in place to handle the influx of data that AI applications require. This may involve implementing robust data governance practices, enhancing data security measures, and investing in scalable cloud-based solutions. They should prioritize talent acquisition and upskilling.

AI implementation requires a skilled workforce with expertise in areas such as data science, machine learning, and AI algorithms. Insurers should identify talent gaps within their organization and actively recruit individuals with the necessary skill sets. Additionally, providing training and development opportunities for existing employees can help bridge the skills gap and ensure that the workforce is equipped to effectively utilize AI technologies.

Insurers should establish a clear AI strategy aligned with their business objectives. It is essential to define the specific areas where AI can bring the most value, whether it’s claims processing, underwriting, customer service, or fraud detection. Developing a roadmap for AI implementation, setting realistic goals, and identifying key performance indicators will help insurers track progress and measure the impact of AI initiatives.

Furthermore, insurers should prioritize ethical considerations and regulatory compliance when implementing AI. AI technologies must operate within legal and ethical boundaries, especially in areas such as data privacy and algorithmic fairness. Insurers should establish robust governance frameworks and policies to ensure transparency, accountability, and compliance with regulatory requirements. This includes regularly assessing and auditing AI systems to identify and mitigate potential biases or unintended consequences.

What Are the Benefits of Using AI in Insurance?

Claims Automation and Acceleration

AI plays a pivotal role in revolutionizing the claims handling process within the insurance industry. By harnessing the power of AI, insurers can streamline and expedite claims processing, resulting in enhanced efficiency and improved customer satisfaction.With AI-powered systems, insurers can automate various key tasks involved in claims handling almost the same risk. These tasks include assessing claims, verifying policy coverage, and processing payments. By automating these processes, insurers can significantly reduce manual intervention, minimize delays, and expedite the overall claims settlement process. Customers benefit from faster claims resolution, which leads to greater satisfaction and retention.

AI systems have the capability to detect and prevent fraudulent claims more effectively. By analyzing vast amounts of data, including historical claims records, internal data, customer profiles, and other relevant information, AI algorithms can identify patterns and indicators of potential fraud. This allows insurers to swiftly flag suspicious claims and allocate resources to investigate them further. By mitigating fraudulent activities, insurers can protect their financial resources and ensure that legitimate claims are processed promptly.

Risk Management and Loss Prevention

In today’s dynamic and unpredictable business landscape, AI emerges as a powerful tool for insurance companies to effectively manage risks and prevent losses. AI’s capabilities in identifying potential hazards, assessing risks, and suggesting mitigation strategies are revolutionizing the risk management landscape. By harnessing AI technologies like Internet of Things sensors and advanced data analytics, insurers can collect and analyze real-time data on insured assets. These IoT sensors provide valuable insights into asset conditions, environmental factors, and operational performance. By continuously monitoring this data, insurers gain a comprehensive understanding of risks associated with insured assets, enabling them to proactively identify potential hazards and vulnerabilities.

With AI-driven risk management systems, insurers can leverage sophisticated algorithms to analyze vast amounts of data and detect patterns that may signify risks. By utilizing machine learning and predictive modeling techniques, insurers can evaluate the probability and severity of risks, enabling them to make informed decisions and take preemptive actions to mitigate those risks. This proactive risk monitoring approach minimizes the occurrence of claims and reduces the financial impact of potential losses.

Streamlined Regulatory Compliance

In the insurance industry, regulatory compliance is of utmost importance to ensure fair practices, protect consumers, and maintain the integrity of the market. AI emerges as a game-changer in this domain, offering significant advantages to insurers in meeting regulatory requirements efficiently and effectively. AI-powered systems can automate compliance-related tasks and processes, reducing the manual effort and potential errors associated with manual compliance management. By leveraging natural language processing (NLP) and machine learning algorithms, these systems can monitor and analyze changes in regulations, helping insurers stay updated and adapt their practices accordingly. This proactive approach saves time and resources for compliance teams, allowing them to focus on more strategic initiatives.

AI can assist insurers in assessing policy compliance by analyzing vast amounts of policy documentation, contracts, and legal texts. Through advanced text analysis and pattern recognition, AI systems can identify potential compliance issues and discrepancies, ensuring that commercial insurers’ policies adhere to regulatory guidelines. This automated process not only enhances accuracy but also helps insurers identify and rectify compliance gaps promptly.

4 Cases of Using AI in Insurance Underwriting

Automated Risk Assessment

AI can assist in automating the risk assessment process human underwriter by analyzing vast amounts of data and identifying patterns and correlations. By leveraging machine learning algorithms, insurers can develop AI models that can quickly evaluate an applicant’s risk profile based on factors such as age, health history, occupation, and other relevant data. This helps underwriters make more accurate and efficient decisions, ensuring that policies are appropriately priced based on the individual’s risk level.

The use of AI in risk assessment enables insurers to leverage a broader range of data sources beyond traditional underwriting information to assess risk further. This includes data from wearable devices, social media activity, and even satellite imagery, providing a more holistic view of an applicant’s risk profile. By incorporating these additional data points, insurers can identify potential risks that might have been overlooked using traditional methods, leading to more accurate risk assessments.

Fraud Detection

AI-powered systems can significantly improve fraud detection in the insurance underwriting process. By analyzing historical data, claims records, and other relevant information, AI algorithms can identify suspicious patterns and anomalies that may indicate fraudulent activities. These systems can flag high-risk applications for further investigation, helping underwriters identify and mitigate potential fraud risks. AI-based fraud detection models can analyze vast amounts of data in real-time, enabling insurers to quickly identify fraudulent behaviors and take necessary actions.

These models can detect various types of fraud, including falsified claims, staged accidents, and identity theft. By leveraging advanced machine learning techniques, AI algorithms can continuously learn from new fraud patterns and adapt to evolving fraud schemes, ensuring that insurers stay ahead of fraudsters. The integration of AI-powered fraud detection systems into the underwriting process improves the overall accuracy and efficiency of fraud detection. Traditional manual methods often rely on human judgment, which can be time-consuming and prone to errors.

Predictive Underwriting

AI can help assisting underwriters by leveraging predictive analytics. By analyzing a wide range of data, including market trends, customer behavior, and historical claim patterns, AI models can predict future risks and potential losses with a higher degree of accuracy. This enables underwriters to make informed decisions and offer personalized policies tailored to individual needs. The use of AI in predictive underwriting enables insurers to assess risks more effectively and determine appropriate pricing and coverage.

By analyzing historical data and identifying patterns, AI algorithms can identify potential risk factors that may influence the likelihood of claims. These algorithms can consider multiple variables and their interrelationships, allowing underwriters to gain deeper insights into risk profiles and make data-driven decisions. AI-powered predictive underwriting models can help all insurers assess risk and optimize their risk management strategies. By identifying emerging trends and potential risks in real-time, underwriters can proactively adjust their underwriting guidelines and policies. This proactive approach not only helps insurers mitigate potential losses but also allows them to identify new market opportunities and offer innovative insurance products.

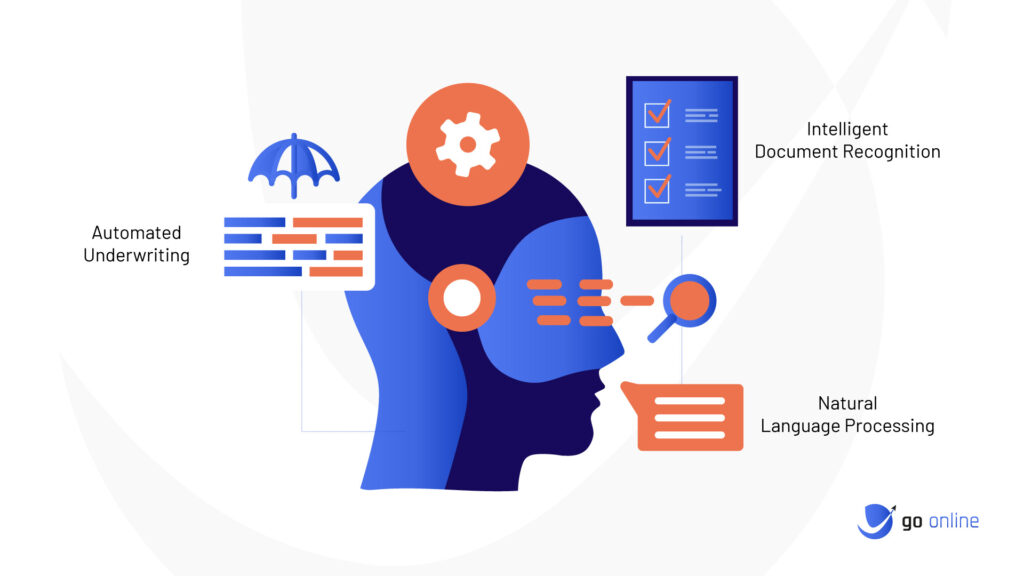

Natural Language Processing in Underwriting Analysis

Natural Language Processing, a subset of AI, revolutionizes the underwriting analysis process by enabling machines to understand and interpret human language with remarkable accuracy. In the context of insurance and underwriting automation, NLP can be a powerful tool for extracting valuable insights from a wide range of unstructured sources, such as medical records, legal documents, customer emails, and even social media posts. By leveraging NLP algorithms, insurers can automate the extraction of relevant information from these sources, saving significant time and effort for underwriters.

NLP-powered systems can identify and extract key details, such as medical conditions, occupation, and past claims history, allowing underwriters to make well-informed decisions based on comprehensive and structured data. The application of NLP in underwriting analysis not only accelerates the process but also enhances accuracy and consistency. By removing manual interpretation and reliance on subjective judgment, NLP-powered systems minimize the risk of human errors and ensure a more objective evaluation of risks. Underwriters can access standardized and digitized information, enabling them to assess policy applications with greater efficiency and precision.

Key Applications of Artificial Intelligence in Concluding Insurance Contracts

Natural Language Processing

NLP is a powerful tool that enables machines to understand and interpret human language, and its application in the insurance industry is revolutionizing the way insurance contracts are concluded. NLP algorithms have the ability to analyze unstructured data from a wide range of sources, including policy documents, claims records, and customer communications. This technology plays a crucial role in extracting and deciphering relevant information and insights that are critical for underwriting decisions. By automating the process of analyzing and understanding the content of insurance-related documents, NLP algorithms streamline the underwriting process and help insurers make accurate and informed decisions.

Through NLP, insurers can effectively process and interpret the vast amount of unstructured data present in insurance contracts. These algorithms are designed to identify key information such as policy terms and conditions, coverage limits, exclusions, and deductibles. By extracting this information accurately and efficiently, NLP algorithms enable insurers to evaluate risks more effectively and ensure that policyholders are provided with appropriate coverage.

Intelligent Document Recognition

AI-powered systems have revolutionized the way insurance contracts are concluded, particularly through the automation of document processing tasks. With techniques such as optical character recognition (OCR) and intelligent character recognition (ICR), AI algorithms can analyze insurance documents with remarkable accuracy and efficiency. These algorithms can extract essential information from policy documents, application forms, claims records, and other relevant paperwork, ensuring that data is accurately captured and verified. By automating document processing, AI eliminates the need for manual data entry, which is often time-consuming and prone to both human error or errors.

The algorithms can swiftly read and interpret the text within documents, extracting relevant data points such as names, addresses, policy numbers, coverage details, and more. This not only speeds up the contract conclusion process but also improves data accuracy, reducing the risk of errors that could potentially lead to disputes or policy discrepancies.

Automated Underwriting

AI algorithms have revolutionized the underwriting process by enabling the analysis of vast amounts of data to assess risks associated with insurance applicants. By leveraging machine learning techniques, AI systems can swiftly evaluate an applicant’s risk profile by considering numerous factors such as age, health history, occupation, lifestyle choices, and other relevant data points. This advanced analysis empowers human underwriters to to make more informed decisions when determining policy terms and pricing, ensuring that insurance policies are appropriately tailored to individual risk levels.

The use of AI in automated underwriting not only enhances efficiency but also improves the accuracy and consistency of risk assessment. It enables insurers to process applications more quickly, reduce manual effort, and minimize human bias in decision-making. By leveraging AI’s analytical capabilities, underwriters can optimize their evaluation processes, resulting in more precise risk assessment and more suitable coverage options for applicants. Ultimately, automated underwriting powered by AI technology enhances the overall underwriting process, leading to more efficient operations, better risk management, and improved customer satisfaction.

What Is The Future of The Insurance Industry?

The insurance industry is undergoing a significant transformation, driven by advancements in technology and evolving customer expectations. The future of the insurance industry holds immense potential for innovation, disruption, and enhanced customer experiences. Several key trends and developments are shaping the future of this industry. One of the most prominent trends is the integration of artificial intelligence (AI) and data analytics into various aspects of the insurance value chain. AI-powered systems can automate and streamline processes, such as underwriting, claims processing, and risk assessment. With the ability to analyze vast amounts of data quickly and accurately, AI algorithms can make more informed decisions, improve risk prediction models, and enhance overall operational efficiency.

Another crucial aspect of the future of insurance is the emergence of insurtech startups and their disruptive influence on commercial insurance itself. These startups leverage technology to introduce innovative products, services, and business models. From peer-to-peer insurance platforms to on-demand coverage and usage-based policies, insurtech companies are challenging traditional insurance models and pushing the industry toward greater agility and customer-centricity.

Data privacy and cybersecurity are also critical considerations for the future of the insurance industry. With the increasing reliance on digital technologies and the collection of vast amounts of personal data, insurers must prioritize data protection and establish robust cybersecurity measures. Customers need to trust that their sensitive information is secure and that insurers adhere to strict data privacy regulations.

Overcoming Challenges and Ensuring Success

Implementing artificial intelligence in the insurance industry comes with its own set of challenges. However, with proper strategies and considerations, these challenges can be overcome to ensure the success of AI initiatives. One of the primary challenges is data quality and availability. Insurance companies must ensure that they have access to accurate and reliable data for training AI models. This involves data extraction, cleansing, integration, and ensuring data privacy and security. Companies need to invest in robust data management systems and processes to ensure the integrity and availability of data for AI applications. Additionally, there may be resistance or skepticism from employees who fear that AI will replace their roles. To address this, organizations need to emphasize the collaboration between humans and AI, highlighting how AI can augment human capabilities rather than replace them. Companies can focus on reskilling and upskilling employees to work alongside AI systems and leverage their capabilities for more strategic tasks.

Regulatory compliance is another crucial challenge when implementing AI in insurance. Insurance companies must navigate the regulatory landscape and ensure that AI systems comply with industry-specific regulations and ethical considerations. The use of AI should be transparent, fair, and accountable. Interpreting AI decisions and ensuring transparency and explainability is essential to build trust with customers and regulators. Companies need to develop AI models and algorithms that are auditable, allowing stakeholders to understand the factors and reasoning behind AI-driven decisions. Implementing robust governance and oversight mechanisms can help address these concerns and ensure compliance with regulatory requirements.

Scalability and adaptability are key considerations in the successful implementation of AI in insurance. AI solutions need to be scalable to handle large volumes of data and adapt to changing business needs and technological advancements. Insurance companies should invest in scalable infrastructure and cloud-based solutions to support the processing and storage requirements of AI applications. Continuous monitoring, evaluation, and refinement of AI models are necessary to maintain their effectiveness over time. Companies should establish feedback loops and mechanisms to collect data on AI performance and user feedback to drive iterative improvements.

Will Artificial Intelligence Replace Humans?

The question of whether artificial intelligence (AI) will replace humans is a topic of significant debate and speculation. While AI has made remarkable advancements in various fields, it is unlikely to entirely replace humans in the foreseeable future. Instead, AI is more likely to complement and augment human capabilities, leading to new opportunities and transforming the nature of work.

One crucial aspect to consider is that AI is designed to perform specific tasks with high efficiency and accuracy, particularly those that involve repetitive or data-intensive processes. AI excels at processing vast amounts of information, recognizing patterns, and making predictions based on historical data. This makes it a valuable tool for tasks such as data analysis, pattern recognition, and automation. However, AI lacks certain qualities that are inherently human, such as creativity, empathy, and complex decision-making based on intuition and ethics.

AI is most effective when combined with human expertise and oversight. While AI algorithms can process data and make predictions, humans are needed to interpret the results, consider contextual factors, and make informed decisions. For example, in the field of finance, AI algorithms can assist in analyzing market trends and making investment recommendations, but the final investment decisions are ultimately made by human portfolio managers who consider broader economic factors and risk appetite.

While AI has the potential to automate certain tasks and reshape job roles, it is unlikely to replace humans entirely. Rather than viewing AI as a threat to human employment, it is more productive to consider it as a tool that can enhance human capabilities, improve efficiency, and enable us to focus on higher-value activities. By leveraging AI effectively, we can create a future where humans and AI collaborate to achieve greater productivity, innovation, and societal progress. Overall, while AI has the potential to automate certain tasks and reshape job roles, it is unlikely to replace humans entirely.

Summary

In the realm of utilizing artificial intelligence (AI) in the insurance industry, the focus is on the application of AI in underwriting. The goal is to explore how AI can revolutionize the underwriting process and deliver substantial advantages.

By harnessing advanced algorithms and data analytics, insurers can obtain valuable insights, automate manual underwriting tasks, and make more informed decisions. This transformative technology enhances risk assessment, streamlines operations, and improves the accuracy and efficiency of underwriting processes.

The incorporation of AI in underwriting is essential for insurers to remain competitive in a rapidly evolving insurance landscape. Through practical examples and real-world use cases, the potential of AI in insurance underwriting becomes evident. This serves as a guide for insurers to embrace AI’s potential and unlock new dimensions of work within the underwriting domain.