In the ever-evolving world of finance and accounting, technological advancements are reshaping traditional processes and driving unprecedented levels of efficiency. One such transformative technology is Robotic Process Automation (RPA). RPA has emerged as a game-changer, automating repetitive tasks, improving accuracy, and freeing up valuable human resources for more strategic activities. In this article, we will explore the impact of RPA on the finance and accounting industry, examining its benefits, use cases, and the significant shift it brings from manual to automatic operations.

Join us as we delve into the realm of RPA and discover how it is revolutionizing the way finance and accounting professionals work, providing organizations with a competitive edge in today’s fast-paced business landscape.

What does RPA mean?

RPA stands for Robotic Process Automation, which is a technology that allows organizations to automate repetitive, rule-based tasks and processes using software robots or “bots.” These bots mimic human actions and interactions with digital systems, enabling them to perform tasks such as data entry, calculations, report generation, and more. RPA operates on predefined rules and instructions, eliminating the need for human intervention in routine, mundane activities.

By leveraging RPA, organizations can streamline operations, improve accuracy, and enhance productivity, ultimately driving cost savings and enabling employees to focus on higher-value, strategic initiatives. RPA is a powerful tool that is reshaping the way businesses approach their workflows and transforming the finance and accounting industry in particular.

What is RPA in Finance?

In the same finance automation domain, RPA software robots are deployed to handle repetitive, rule-based tasks such as data entry, reconciliation, invoice processing, and report generation. By automating these manual and time-consuming activities, RPA enables finance teams to achieve higher levels of efficiency, accuracy, and compliance. It eliminates the risk of human error, accelerates data processing, and frees up valuable resources to focus on strategic financial analysis, decision-making, and customer-centric activities.

What is RPA in Accounting?

RPA software robots are designed to perform repetitive and rule-based accounting tasks such as data entry, transaction processing, financial statement preparation, and compliance checks.

The software robots can seamlessly integrate with existing accounting systems and applications, allowing for seamless data transfer and enhanced data accuracy. RPA enables accountants to focus on value-added activities such as financial analysis, strategic decision-making, and client advisory services.

How RPA Works with AI and ML

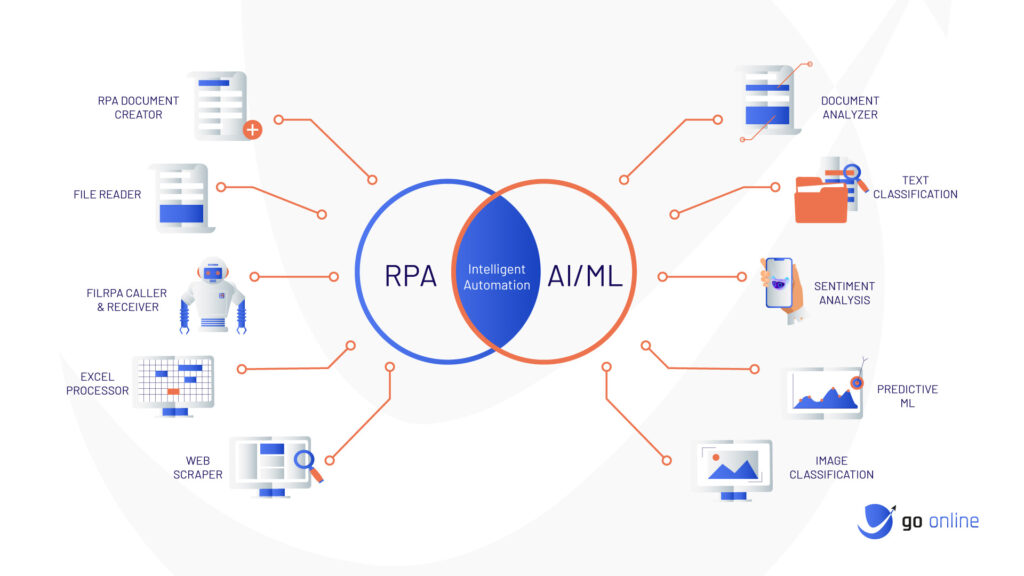

RPA (Robotic Process Automation) works in tandem with AI (Artificial Intelligence) and ML (Machine Learning) to enhance its capabilities and effectiveness. While RPA focuses on automating repetitive tasks based on predefined rules and instructions, AI and ML introduce intelligence and learning capabilities to the automation process.

By incorporating AI and ML algorithms, RPA systems can analyze and interpret unstructured data, make intelligent decisions, and adapt to changing scenarios.

AI enables RPA bots to understand and process natural language, perform complex data analysis, and even handle exceptions or variations in tasks. ML algorithms allow RPA systems to learn from historical data, identify patterns, and continuously improve their performance over time.

What is the Impact of RPA on Finance and Accounting?

One of the significant impacts of implementing RPA on finance and accounting is the potential for cost savings. By automating repetitive tasks, organizations can reduce the need for manual labor, leading to decreased operational costs associated with hiring and training employees.

RPA enables organizations to achieve higher productivity levels with fewer resources, resulting in significant cost efficiencies.

RPA brings a remarkable improvement in accuracy to finance and accounting processes. Unlike humans, RPA bots are not prone to errors or fatigue. They follow predefined rules consistently and execute tasks with precision, leading to greater accuracy in data entry, calculations, and financial reporting.

The reduction in errors minimizes the risk of financial discrepancies and enhances the reliability of financial data.

RPA streamlines finance and accounting processes, eliminating time-consuming manual tasks. By automating repetitive activities, RPA accelerates data processing, transaction reconciliation, and report generation, resulting in improved efficiency and faster turnaround times.

It enables finance and accounting teams to accomplish more in less time, enhancing overall productivity within the organization.

Compliance and auditability are crucial aspects of finance and accounting. RPA ensures adherence to regulatory standards and internal controls by executing tasks according to predefined rules and regulations.

RPA logs every action performed, creating a comprehensive audit trail for easier tracking and verification.It provides organizations with greater confidence in their financial operations.

RPA offers scalability and flexibility in managing finance and accounting processes. As business needs evolve, RPA can be easily scaled up or down to accommodate changing volumes and requirements.

Whether it’s handling an increased workload during peak periods or adapting to new regulations, RPA provides the flexibility to scale operations without compromising efficiency or accuracy.

RPA promotes process standardization by enforcing predefined rules and procedures consistently across finance and accounting functions. This ensures uniformity in data entry, reconciliation, and reporting, reducing variations and errors that may occur with manual processes.

Standardization enhances process efficiency, facilitates data comparability, and improves the overall quality of financial information.

By automating repetitive and time-consuming tasks, RPA liberates finance and accounting professionals to focus on strategic decision-making. With RPA handling routine activities, finance and accounting teams can devote more time to data analysis, financial forecasting, and strategic planning.

This enables organizations to make informed decisions based on accurate and timely financial insights, driving business growth and profitability.

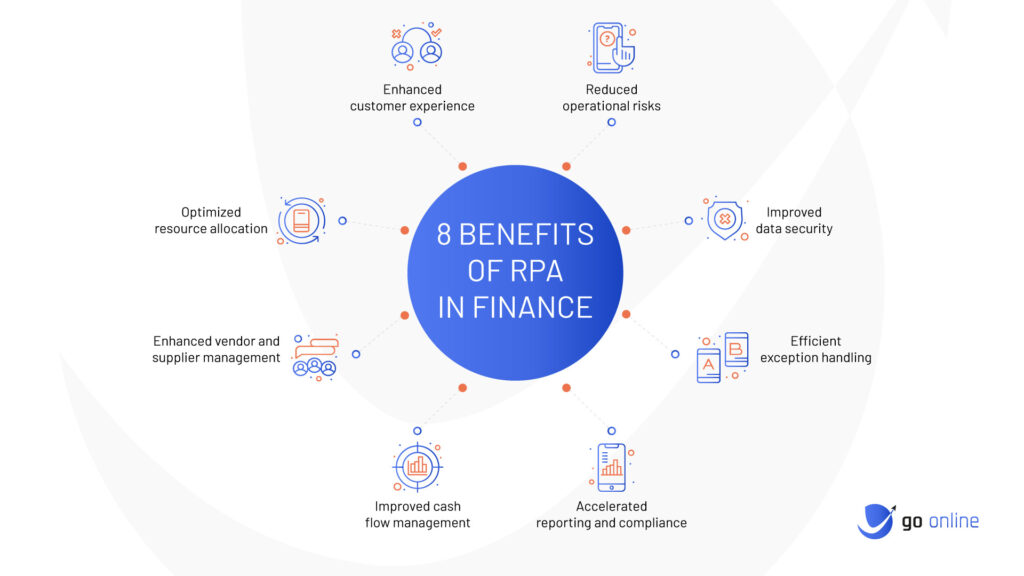

8 Benefits of RPA in Finance

Enhanced customer experience

Robotic Process Automation (RPA) in finance can significantly improve the customer experience by streamlining customer onboarding and expediting processes. With RPA handling routine tasks, customers can enjoy faster response times, reduced wait times for approvals or account updates, and improved overall service quality.

Reduced operational risks

RPA minimizes operational risks within finance processes by eliminating human errors and increasing process consistency. By automating tasks such as data validation and reconciliation, RPA ensures accuracy and reduces the likelihood of errors that could lead to financial discrepancies or regulatory non-compliance.

Improved data security

RPA enhances data security in finance operations by reducing the risk of unauthorized access, data breaches, and human error. RPA bots operate within predefined access controls and follow strict security protocols, minimizing the potential for data leaks or unauthorized modifications. This increased data security boosts customer trust and protects sensitive financial information.

Efficient exception handling

RPA enables efficient exception handling in finance processes. By identifying and flagging exceptions automatically, RPA allows finance professionals to focus on resolving complex issues rather than spending time on routine and straightforward tasks. It improves overall process efficiency and ensures timely resolution of critical issues.

Accelerated reporting and compliance

RPA expedites the reporting and compliance requirements in finance departments and operations. By automating data collection, consolidation, and report generation, RPA enables faster and more accurate financial reporting. Additionally, RPA ensures compliance by executing predefined rules and regulations consistently, reducing the risk of non-compliance and facilitating smooth audit processes.

Improved cash flow management

RPA can enhance cash flow management in finance by automating tasks such as invoice processing, payment reconciliations, and accounts receivable management. By accelerating these processes, RPA improves cash flow visibility, reduces payment delays, and enhances overall financial liquidity, enabling organizations to make better-informed decisions and optimize their working capital.

Enhanced vendor and supplier management

RPA can streamline vendor and supplier management processes in finance, including tasks such as purchase order management, vendor onboarding, and invoice processing. By automating these activities, RPA improves efficiency, reduces manual errors, and enhances relationships with vendors and suppliers. It also leads to better cost control, improved vendor performance, and strengthened supply chain operations.

Optimized resource allocation

RPA helps optimize resource allocation within finance operations by automating repetitive and time-consuming tasks. By freeing up finance professionals from manual activities, organizations can allocate their resources strategically to more value-added activities, such as financial analysis, risk management, and strategic planning. It improves overall productivity and enables finance teams to focus on activities that drive business growth and profitability.

10 Cases of Using RPA in Finance

Invoice processing

RPA can automate the entire invoice processing workflow, the entire process from data extraction to validation, matching, and payment processing. By eliminating manual data entry and reducing human errors, RPA improves accuracy, speeds up processing times, and ensures timely payments to vendors.

Accounts payable and receivable

RPA can streamline accounts payable and receivable processes by automating tasks such as invoice verification, payment processing, and reconciliation. This reduces processing time, minimizes errors, and improves cash flow management by ensuring timely payments and accurate tracking of outstanding invoices.

Financial statement preparation

PA can automate essential tasks in the preparation of financial statements by gathering data from various sources, performing calculations, and generating accurate reports. This eliminates manual data manipulation, reduces the risk of errors, and speeds up the financial reporting process, allowing finance teams to meet regulatory deadlines and provide timely insights to stakeholders.

Bank reconciliation

RPA can automate bank reconciliation processes by extracting transaction data from bank statements, matching it with internal records, and identifying discrepancies. This eliminates the need for manual reconciliation, improves accuracy, and reduces the time required to identify and resolve discrepancies, resulting in more efficient cash management and financial reporting.

Expense management

RPA can automate expense management processes, including expense report submission, approval, and reimbursement. By extracting data from receipts and automating expense report workflows, RPA improves accuracy, reduces processing time, and enhances transparency and compliance in expense management.

Financial data migration

When organizations undergo system upgrades or migrate to new financial platforms to consolidate data elsewhere, RPA can play a crucial role in data migration. RPA can automate the extraction, transformation, and loading of financial data, ensuring a smooth and accurate transfer of data from legacy systems to new platforms.

Financial regulatory compliance

RPA can assist in ensuring compliance with financial regulations by automating compliance monitoring and reporting processes. RPA can continuously monitor transactions, identify suspicious activities, generate compliance reports, and facilitate regulatory audits, reducing the risk of non-compliance and improving overall governance and control of financial institutions.

Financial forecasting and planning

RPA can automate data collection, analysis, and modeling processes involved in financial forecasting and planning. By using automated processes for gathering data from various sources, performing calculations, and generating forecasts, RPA enables more accurate and timely financial projections, supporting strategic decision-making and budgeting processes.

Risk management and fraud detection

RPA can enhance risk management and fraud detection in finance by automating the monitoring and analysis of financial transactions. RPA can flag anomalies, identify patterns indicative of fraudulent activities, and generate alerts for further investigation. This improves fraud detection capabilities, reduces financial risks, and safeguards the organization or financial institution’s assets.

Compliance with internal controls

RPA can automate the enforcement of internal controls within finance processes, ensuring adherence to policies, procedures, and segregation of duties. RPA can validate approvals, perform reconciliations, and generate audit trails, providing an extra layer of control over finance functions and ensuring compliance with internal governance requirements.

Risk Related to RPA in Banking and Finance

Implementing Robotic Process Automation (RPA) in banking and finance comes with certain risks that organizations need to be aware of. One of the primary risks is the potential for errors or glitches in the RPA system.

If the RPA bots are not properly designed, tested, or monitored, they may introduce inaccuracies or inconsistencies in financial data, leading to incorrect reporting, compliance issues, or even financial losses. Additionally, since RPA relies heavily on automation and integration with various systems, there is a risk of unauthorized access or breaches of sensitive financial data.

Organizations must ensure robust security measures, such as encryption and access controls, to protect against data breaches and maintain data integrity. Another risk is over-reliance on RPA without proper human oversight. While RPA can improve efficiency and accuracy, it is crucial to have human supervision and control to address exceptions, handle complex situations, and ensure the appropriate decision-making process.

Summary

By leveraging RPA technology, organizations can unlock a multitude of benefits, including heightened efficiency, enhanced accuracy, improved compliance, and scalability. The subject delves into the diverse applications of RPA in finance and accounting, spanning areas such as invoice processing, accounts payable/receivable, financial statement preparation, and more.

Moreover, it delves into the challenges and risks that may arise during RPA implementation and offers valuable insights on effective strategies for overcoming them. Overall, this subject sheds light on the game-changing nature of RPA solutions, empowering organizations to optimize their operations, allocate resources effectively, and make informed decisions for long-term success.