Financial software development has its specific demands, and it’s important to know them if you need a full-fledged product that will meet industry standards. You need to integrate future-proof solutions into your fintech strategy, so that software will be able to keep up with many challenges of the rapidly developing and changing market.

In this article, I will reveal the process, and stages of creating modern FinTech software, familiarize you with technologies and security features and talk about the possibilities of outsourcing. So without further ado, let’s dive in!

What Is Financial Software Development?

Financial software development is the process of developing, optimizing, and implementing software programs in the finance and banking industry. FinTech or development is about creating an ecosystem where it would be possible to make transactions related to finances timely, convenient, and customer-focused. Many institutions in the financial sector are thinking about introducing different software to their businesses because it can eliminate excessive bureaucratic obstacles in the bank infrastructure and make the customer experience better.

What Are The Key Financial Software Features?

Fintech applications share many common features that are essential for proper security and flawless user experience. Here are the most important ones

Sign Up and Sign In

No financial software can work properly without secure registration and login functionality. This part has to be not only visually pleasing but also be secure from the customer side. You may want to implement two factor authentication, with one of them being biometrics, and a SMS confirmation, when a user wants to sign in on a new device.

Dashboard

Financial apps offer a broad range of tools to their users. Therefore, keeping all of them on a convenient dashboard would be a wise choice. In this section you can display charts and diagrams to monitor for example customer spending habits.

Payment Gateway

A payment function is an essential feature of any fintech app. Integrate one or more payment gateways so users can conveniently make transfers on your platform.

Security

Security in a FinTech application is critical as users trust you with confidential personal data and sensitive information about their finances. You should provide your application with security features like, encryption methods, biometric and two-factor authentication/

Push Notifications

If you’re planning to launch your FinTech software as a mobile application, then push notifications are one of the essential functionalities. It can notify the user about their recent incomes as spendings, or send them special offers.

QR Code Scanning

This feature will make the process of interaction with the application swift and simple. Nowadays, many transfers work through QR codes, so adding a scanner to your FinTech software is a good idea.

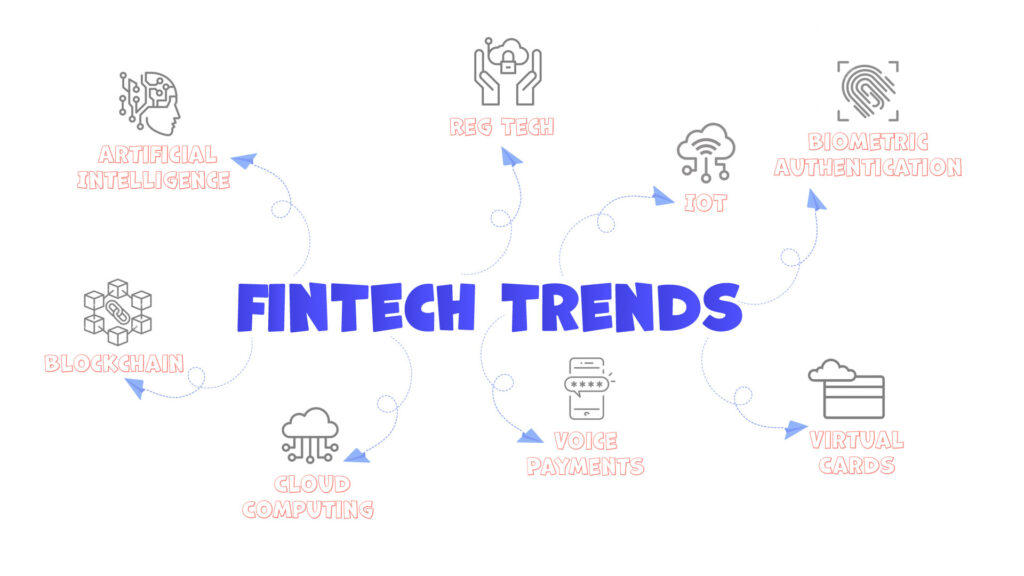

Recent Trends In Custom Financial Software Development

New realities have become an incentive for the financial industry development, due to the rapid development of the FinTech market which will grow to $31.5 billion by 2026, financial software development companies have to implement bleeding-edge technologies and solutions to keep up with competitors, and deliver a product which can meet a modern customer demands. Here’s a list with a recent trends in the FinTech Industry

Artificial intelligence

Companies in the financial sector can use Artificial Intelligence (AI) to analyze and manage data from multiple sources to gain valuable insights. These innovative results help banks address the challenges they face daily in delivering everyday services such as payment processing. There are numerous benefits of using AI in your business. It can analyze user behavior and automate customer service using chatbots available 24/7 which can drastically reduce your company expenses. AI-based analytic tools can help assess credit risk based on collected data, and might be able to detect banking fraud.

Reg tech

RegTech is regulatory technology that allows you to reduce the cost of adapting your business to new regulations. Regulatory technology finds issues that do not comply with the rules and makes them compatible with the system.

The internet of things

The arrival of card payments, then contactless, gave banks data about customers spending. Now, the IoT is revolutionizing payments once more. Thanks to smart devices, customers are able to pay through different devices like phones or smartwatches. Fintech needs to keep up with this trend, offering customers multiple payment options and leveraging the gathered data about customer spending and habits.

Biometric authentication

Biometric authentication is not only faster and convenient, but also a more secure method than using PINs and passwords. When it comes to the financial sector, being a frequent target of attacks and abuses, its uttermost important to provide a secure and convenient authentication method.

Blockchain

Fintech experiences the transformative impact of blockchain technology for generating more revenue, delivery process, efficiency, improving the end-user experience, and reducing risks in business operations. Fintech makes up a significant share in the blockchain market. The fintech blockchain market is expected to reach a value of $36.04 Billion by the end of the year 2028. Decentralized Finance would be an emerging financial technology based on blockchain that reduces the control of banks on financial services and money. Over the course of decades, we will also notice that digital ledgers will experience a transformation in how we receive, send, store and manage our money.

Cloud computing

FinTech companies are rapidly turning to the cloud to provide businesses and consumers with effective solutions. 87% of FinTech companies are expected to accelerate their cloud migration by 2025.

Virtual Cards

Virtual cards work exactly like your physical bank card—they just live in your digital wallet on your phone instead of your physical wallet. Secured by encryption, they offer a safe and convenient way to pay online and in-store. They also allow you to minimize the amount of personally identifiable information (PII) you share with places you buy at.

Voice Payments

Voice payment is a process of speaking to an artificial intelligence-powered device, such as a speaker or a smartphone, and requesting it to make a payment. This technology comes from the advancements made in artificial intelligence. In the modern world’s fast-paced environment, most consumers opt for voice command, including voice payment, because it is convenient and practical. It provides users with modern customer experience as well as minimizing fraud, providing another layer of multi-factor authentication.

FinTech Regulations That Businesses Have To Comply With

GDPR

The General Data Protection Regulation (GDPR), is the toughest privacy and security law in the world. Though it was drafted and passed by the European Union (EU), it imposes obligations onto organizations anywhere, so long as they target or collect data related to people in the EU. The regulation was put into effect on May 25, 2018. The GDPR will levy harsh fines against those who violate its privacy and security standards, with penalties reaching into the tens of millions of euros.

KYC

KYC can be defined as a set of customer information that establishes a customer’s credibility and transactional profile, and allows identity verification to be carried out. With a carefully managed KYC policy, customers can be assured that their data is protected and services are carried out in a secure manner. Indeed, the main purpose of KYC is to prevent financial scams, identity theft, money laundering (AML) or terrorist financing.

GLBA

The Gramm-Leach-Bliley Act requires financial institutions – companies that offer consumers financial products or services like loans, financial or investment advice, or insurance – to explain their information-sharing practices to their customers and to safeguard sensitive data.

FCRA

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection of consumers’ credit information and access to their credit reports. It was passed in 1970 to address the fairness, accuracy, and privacy of the personal information contained in the files of the credit reporting agencies.

PCI DSS compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a set of requirements intended to ensure that all companies that process, store, or transmit credit card information maintain a secure environment. It was launched on September 7, 2006, to manage PCI security standards and improve account security throughout the transaction process. The standard highlights six areas that businesses need when preparing their app to meet the PCI DSS compliance. The fees for non-compliance can be anywhere between $5,000 to $100,000 to be paid every month.

EFTA

The Electronic Fund Transfer Act is governed by the Consumer Financial Protection Bureau, and looks after the electronic money transfers via ATMs, POS terminals, and debit cards is a federal law that protects consumers when they transfer funds electronically, including through the use of debit cards, automated teller machines (ATMs), and automatic withdrawals from a bank account. Among other protections, the EFTA provides a way to correct transaction errors and limits the liability resulting from a lost or stolen card.

Stages of FinTech Software Development

Every Fintech has its peculiarities, depending the scale and the sector of business, although essentially, the stages of the Fintech development process are following:

Gathering and Analyzing Business Needs

Every new activity, every new product, every new project in the workplace is created in response to a business need. Before developing a Fintech application, you need to create a digital strategy and gather relevant data. The team has to discuss the future project and define its scope, so that they can assess the timescales and resources needed to complete it. Depending on the product you need – a service for personal financial management, trading platform, or blockchain solution, – the team analyzes the existing market and writes a detailed business plan.

Ideation

Once the needs and expectations are understood and research into all technical aspects is complete, the creative process begins. During ideation, we get the ideas churning. Some may be new or revolutionary, and others may simply be improvements on existing solutions. Nevertheless, your team should continue to analyze the ideas and combine them to create a solution that satisfies your needs

Design

When all ideas have been selected, the creation of the FinTech software design from the requirement’s documentation starts. Product design assists in the specification of the necessary hardware required to run the product, in other words, the deployment. It also helps in clearly marking out the general product architecture, depicting the software modules required to be developed and their relationships.

Coding

After the phase of product design, the development team moves on to the stage of coding and implementation. Once the development team has the requirement specification and the design documents ready, the developer team can start programming. Besides coding, the developers also perform unit or module testing in this phase, in order to detect potential problems as soon as possible.

Testing

After completing coding and implementation, the team can then proceed to the integration and validation test phase. Software development service teams are in the constant software process of releasing different software applications for various purposes, as this process is necessary as it is important to test the product against all parameters available vigorously. This phase exposes potential bugs in the product, and if any, these are corrected.

Deployment and Maintenance

Once your FinTech product passes the testing phase, you can start deploying the product. Once the product is ready, the first batch is rolled out and opened to the public. That is known as Beta testing. If any changes are required, or any bugs not seen during the testing phase arise, they can be corrected and implemented during this phase.

Outsourcing FinTech Software Development

Outsourcing software development is a really great way to improve operational efficiency and create a better customer experience, among other perks, in the financial domain at a reasonable price. It can help to reduce business risk and provide the same services for a lower cost. Many outsourcing companies, as well as individuals, can provide the same in-house services for a lower price. This saves companies from needing to hire personnel at higher pay rates. Outsourcing a project to a fintech development company in another country can come with significant financial benefits considering the tax benefits.