Welcome to an exciting exploration of the possibilities that artificial intelligence (AI) brings to the realm of accounting for your company. As technology continues to evolve, AI has emerged as a powerful tool, revolutionizing traditional accounting practices and paving the way for more efficient and accurate financial management. In this article, we will delve into the transformative potential of AI in accounting, discussing how it can streamline processes, automate repetitive tasks, provide data-driven insights, and enhance decision-making.

Get ready to discover how AI can empower your company to achieve greater productivity, accuracy, and strategic advantage in the dynamic world of accounting and finance professionals.

Evolution of AI in Accounting

The evolution of artificial intelligence (AI) in accounting has been a remarkable journey, reshaping the way financial tasks are performed. Initially, AI applications in accounting focused on automating repetitive and manual tasks, such as data entry and transaction categorization. With advancements in machine learning and natural language processing, AI systems became capable of analyzing large volumes of financial data, detecting patterns, and identifying anomalies with unprecedented speed and accuracy.

As technology progressed, AI expanded its capabilities to include predictive analytics, enabling organizations to make data-driven forecasts and strategic decisions. Today, AI-powered accounting solutions leverage sophisticated algorithms and neural networks to handle complex tasks like financial reporting, risk assessment, and fraud detection.

The evolution of AI in accounting continues to unfold, promising further advancements in areas such as cognitive computing, robotic process automation, and intelligent financial insights. The integration of AI into accounting practices is revolutionizing the field, empowering accountants and finance professionals to leverage automation, gain valuable insights, and focus on strategic activities that drive business growth.

Benefits of Using AI in Accounting

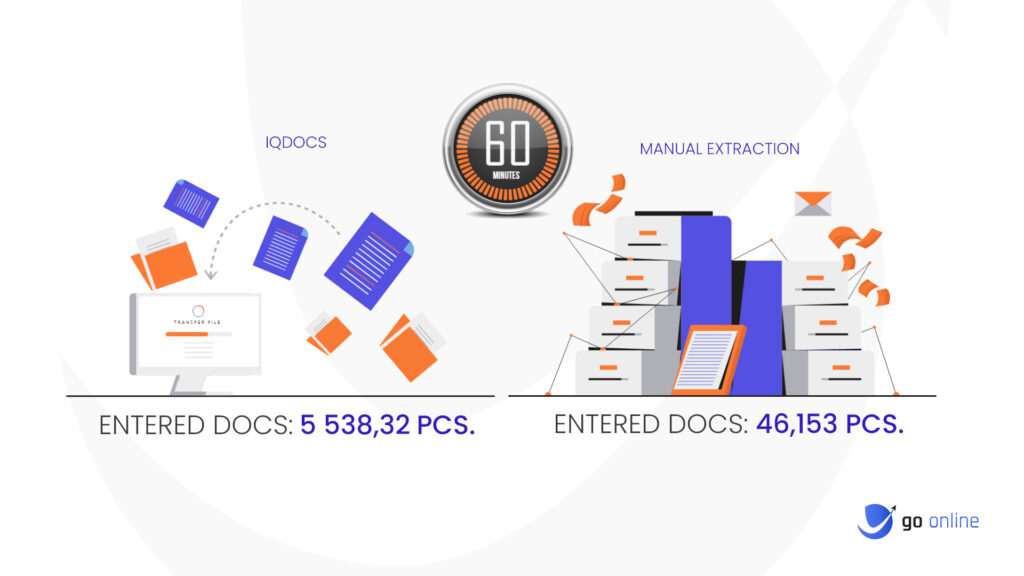

Increased Efficiency

Utilizing AI in accounting processes significantly boosts efficiency by automating repetitive tasks and streamlining workflows. AI-powered systems can handle data entry, transaction categorization, and report generation with remarkable speed and accuracy, saving valuable time for accountants. By automating these routine tasks, accounting professionals can focus on more strategic activities that require critical thinking and analysis, thereby increasing overall efficiency in the accounting process.

Improved Accuracy

AI brings a higher level of accuracy to accounting processes by minimizing human error and cognitive biases. With advanced algorithms and machine learning capabilities, AI systems can meticulously analyze vast amounts of financial data, identify patterns, and reconcile discrepancies. This reduces the likelihood of manual errors and enhances the accuracy of financial reporting, ensuring that financial statements are reliable and compliant with accounting standards.

Cost Savings

Integrating AI into accounting operations can lead to substantial cost savings for organizations. By automating manual accounting tasks, companies can reduce the need for extensive human resources, resulting in decreased labor costs. Additionally, AI systems can identify inefficiencies and optimize resource allocation, maximizing cost-effectiveness throughout the accounting function. AI-powered technologies eliminate the need for manual data entry, reducing the chances of costly errors that may require time-consuming and expensive corrections.

Enhanced Fraud Detection

AI plays a vital role in detecting and preventing fraudulent activities in accounting processes. By analyzing vast amounts of financial data and transactional patterns, AI systems can identify irregularities, anomalies, and potential fraudulent activities in real-time. These advanced algorithms enable early detection of suspicious transactions, unauthorized access, or fraudulent practices, enhancing AI technology overall fraud detection capabilities and protecting the company’s financial integrity.

Better Compliance

The complex landscape of accounting regulations and compliance requirements can be effectively managed with the help of AI. AI systems can continuously monitor and analyze financial transactions, ensuring compliance with regulatory standards and internal policies. By automating compliance processes, such as risk assessments, internal control evaluations, and regulatory reporting, organizations can minimize compliance risks, avoid penalties, and maintain transparency and integrity in financial operations

How AI Changes Accounting

Artificial intelligence (AI) has brought about transformative changes in the field of both accounting and finance, revolutionizing traditional practices and reshaping the role of accountants. AI has automated manual and repetitive tasks, freeing up accountants’ time to focus on higher-value activities that require critical thinking and analysis.

By leveraging AI algorithms and machine learning, accountants can process large volumes of financial data quickly and accurately, leading to improved efficiency and productivity. AI also enhances the accuracy of financial reporting by minimizing human errors and biases, ensuring reliable and compliant financial statements. Moreover, AI enables advanced data analytics, empowering accountants to gain deeper insights, identify trends, and make data-driven decisions for business growth.

With AI-driven fraud detection capabilities, accountants can proactively identify suspicious transactions and potential risks, mitigating the impact of fraudulent activities. Additionally, AI-driven compliance tools streamline regulatory compliance, automating processes and minimizing the risk of non-compliance.

The Best Applications That Can be Used For AI in Accounting

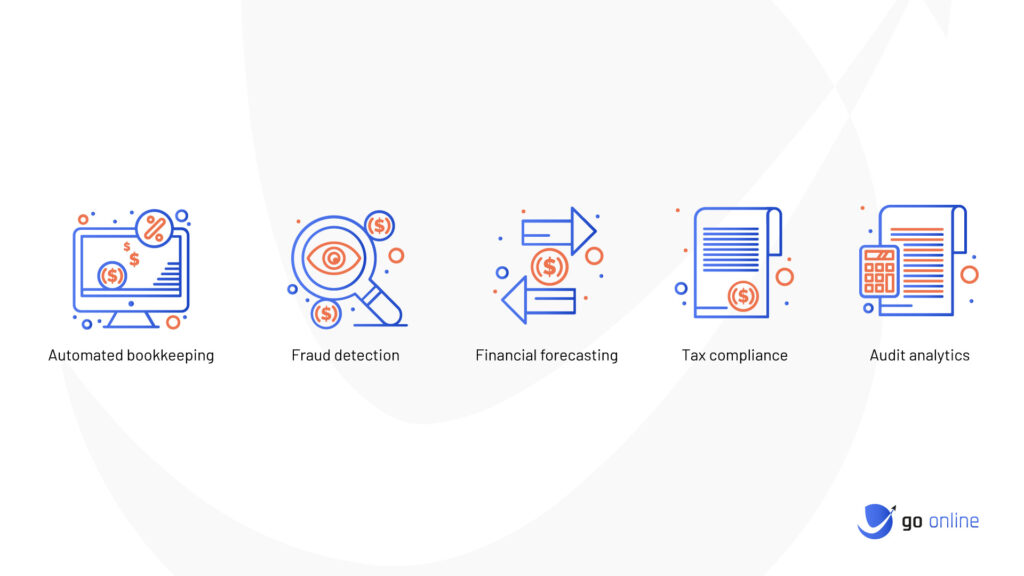

Automated Bookkeeping

Automated bookkeeping is one of the most impactful applications of AI in accounting. By leveraging AI technologies, such as optical character recognition and machine learning algorithms, companies can automate data entry, invoice processing, expense tracking, and bank reconciliation. AI-powered systems can extract relevant information from documents, categorize transactions, and update financial records accurately and efficiently. This reduces the time and effort required for manual bookkeeping tasks, minimizes human errors, and provides real-time visibility into financial data.

Fraud Detection

AI-driven fraud detection systems are invaluable in identifying and preventing fraudulent activities in the accounting and finance industry. These systems employ advanced algorithms that analyze large volumes of financial data to detect patterns, anomalies, and suspicious transactions. By monitoring transactional data in real-time, AI can flag potential fraudulent activities, such as unauthorized access, duplicate payments, or unusual spending patterns. This proactive approach enables companies to mitigate the financial and reputational risks associated with fraud, safeguarding their assets and maintaining trust with stakeholders.

Financial Forecasting

AI-enabled financial forecasting tools provide businesses with valuable insights into future financial performance. By analyzing historical data, market trends, and external factors, AI algorithms can generate accurate forecasts for revenue, expenses, cash flow, and other financial metrics. These AI-driven forecasts enable companies to make informed decisions, allocate resources effectively, and develop strategic plans based on reliable projections. Financial forecasting with AI empowers organizations to navigate uncertainties and optimize their financial strategies for sustainable growth.

Tax Compliance

AI plays a significant role in simplifying tax compliance processes for businesses. AI-powered tax compliance tools can automate tax calculations, identify applicable tax regulations, and ensure accurate tax reporting. By using human intelligence and leveraging natural language processing capabilities, AI systems can analyze complex tax laws, regulations, and updates, enabling accurate interpretation and application. This helps companies comply with tax obligations, minimize errors, and reduce the risk of penalties or audits. AI-driven tax compliance solutions streamline the tax process, freeing up time for accountants to focus on more strategic tax planning activities.

Audit Analytics

AI-powered audit analytics tools revolutionize the auditing process by analyzing vast amounts of financial data efficiently and effectively. These tools can analyze financial data to identify patterns, anomalies, and potential risks, enabling auditors to gain valuable insights and focus on areas of concern. AI algorithms can perform advanced data analytics, comparing financial information against industry benchmarks, identifying discrepancies, and improving audit accuracy. By leveraging AI in audit analytics, companies can enhance audit efficiency, strengthen internal controls, and ensure compliance with auditing standards and regulations.

How AI is Used in Accounting

Automated Data Entry and Bookkeeping

AI is used in the accounting sector to automate data entry processes, reducing the need for manual input and minimizing errors. AI-powered systems can extract relevant information from documents, such as invoices and receipts, and accurately populate financial records. By streamlining bookkeeping tasks, AI enables accountants to focus on higher-value activities while ensuring accurate and up-to-date financial data.

Fraud Detection and Risk Assessment

AI plays a vital role in identifying fraudulent activities and assessing financial risks. By analyzing large volumes of data and detecting patterns, AI algorithms can flag suspicious transactions and potential anomalies in financial processes that may indicate fraudulent behavior. This helps organizations proactively prevent and mitigate fraud, protecting their financial integrity and minimizing financial losses.

Financial Forecasting and Predictive Analytics

AI-driven financial forecasting tools leverage historical data, market trends finance industry,, and other relevant factors to generate accurate predictions and forecasts. By analyzing complex data sets and identifying patterns, AI enables organizations to make informed decisions about future financial performance. Financial forecasting with AI provides valuable insights for strategic planning, resource allocation, and risk management.

Tax Planning and Compliance

AI is utilized in accounting to simplify tax planning and ensure compliance with tax regulations. AI-powered systems can analyze tax laws, regulations, and updates, providing accurate tax calculations and identifying eligible deductions and credits. By automating tax compliance processes, AI helps accounting firms and organizations reduce errors, avoid penalties, and streamline tax reporting.

Audit Analytics and Risk Assessment

AI is employed in audit analytics to improve the efficiency and effectiveness of auditing processes. AI algorithms can analyze large amounts of financial data, identify anomalies, and assess compliance with auditing standards. By automating data analysis and risk assessment, AI enhances audit accuracy, identifies potential areas of concern, and enables auditors to focus on critical aspects of the audit.

Case Study – Using AI in Accounting

In our case study, we explore how a leading financial services company successfully implemented AI in its accounting processes, transforming its operations and achieving significant benefits. The company faced challenges with manual data entry, error-prone reconciliation, and time-consuming financial analysis. By adopting an AI-powered accounting solution, they automated data entry tasks, reducing errors and freeing up valuable time for their accountants.

The AI system utilized machine learning algorithms to categorize transactions, enabling quick and accurate financial reporting. The company leveraged AI for fraud detection, allowing the system to analyze patterns, identify anomalies, and flag potential fraudulent activities. This proactive approach improved the company’s ability to detect and prevent fraud, safeguarding its financial assets and preserving its reputation.

Through this case study, it becomes evident how the integration of AI in accounting processes revolutionized the company’s operations. By automating manual tasks, improving fraud detection, enhancing financial forecasting, ensuring tax compliance, and streamlining audit analytics, the company achieved increased efficiency, improved accuracy, and better decision-making capabilities.

The Future of Accounting That Will Use AI

The future of accounting holds immense promise as the integration of artificial intelligence continues to advance. AI is set to revolutionize the accounting landscape, transforming traditional practices and unlocking new possibilities. With AI-powered automation, routine and repetitive tasks will be streamlined, allowing accountants to focus on higher-value activities such as data analysis, strategic planning, and decision-making.

Advanced AI algorithms will enable real-time financial insights, predictive analytics, and forecasting, empowering organizations to make proactive and data-driven decisions. Additionally, AI will enhance fraud detection capabilities, providing businesses with robust tools to identify and mitigate risks efficiently. The future of the accounting industry will also witness increased integration between AI and other emerging technologies like blockchain, enabling enhanced security, transparency, and efficiency in financial transactions and record-keeping.

As AI continues to evolve, it will undoubtedly reshape the accounting profession, empowering accountants with powerful tools and insights, while improving overall efficiency, accuracy, and compliance in financial management.

Summary

We delved into the possibilities of utilizing artificial intelligence (AI) in accounting to transform financial management practices for your company. We explored the evolution of AI in accounting, highlighting its role in many accounting jobs by increasing efficiency, improving accuracy, saving costs, enhancing fraud detection, and ensuring better compliance. We discussed how AI changes accounting by automating tasks, providing advanced analytics and insights, and simplifying complex processes.

Furthermore, we presented the best applications of AI in accounting, including automated bookkeeping, fraud detection, financial forecasting, tax compliance, and audit analytics. If you’re seeking to leverage the power of AI to streamline your company’s accounting operations, our solutions offer innovative AI-driven tools and expertise to drive efficiency, accuracy, and strategic decision-making.

Discover the possibilities AI can bring to your accounting processes with our cutting-edge solutions.